How your occupation can impact the cost of protecting your income

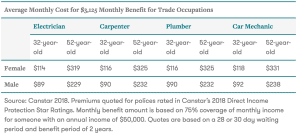

Premium data collected by Canstar Research for policies rated in the 2018 Direct Income Protection Star Ratings provides an insight into the difference your occupation is likely to make on the cost of direct income protection insurance, a policy purchased directly from the provider instead of through a financial advisor.

Why the comparison? Well, a person’s occupation is one of the main influencing factors on the price of direct income protection premiums, given different occupations carry different risks.

The data found tradespeople tend to pay higher premiums than people who earn the same income working in professional, white collar and light blue collar occupations. One of the reasons for this is that a tradesperson required to perform manual labour and operate machinery is typically seen as being more likely to experience a work-related injury than, say, an office worker.

Canstar Research found a 32-year-old female electrician who doesn’t smoke and earns $50K per year who seeks a $3,125 monthly benefit in the case she was unable to work due to sickness or injury would pay an average of $114 each month. If the same person was working as a receptionist also earning $50K and seeking the same monthly benefit, she would on average pay a little more than half (56%) of this amount, approximately $64 per month.

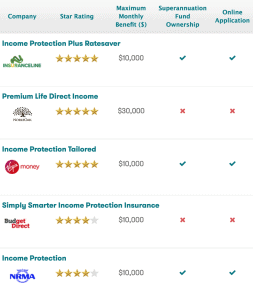

See below table for a snapshot of the current products on offer for direct income protection, based on a 30-39 year old non-smoking female, in a trades and services occupation sorted by our star ratings (highest to lowest).

As some tradespeople are required to have income protection insurance before walking onto a job site, this highlights the importance of finding the best cover for your circumstances and needs at the right price. The average monthly costs for common trade roles based on policies rated in our 2018 Direct Income Protection Star Ratings are presented in the table below:

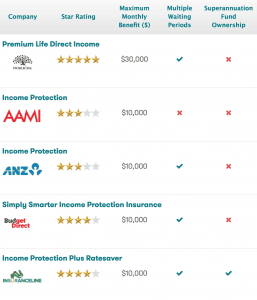

See below table for a snapshot of the current products on offer for direct income protection, based on a 40-49 year old non-smoking male, in a manufacturing, transport and logistics occupation sorted by maximum monthly benefit (highest to lowest).

The data also gives further insight into the difference you can expect to pay based on different job roles with the same income, including a sales assistant with an annual income of $50,000 paying an average of $77 per month for direct income protection coverage compared to a checkout operator who earned the same income paying an average of $103, an average annual difference of $312 for the same monthly benefit.

The data also gives further insight into the difference you can expect to pay based on different job roles with the same income, including a sales assistant with an annual income of $50,000 paying an average of $77 per month for direct income protection coverage compared to a checkout operator who earned the same income paying an average of $103, an average annual difference of $312 for the same monthly benefit.

According to our data, a 32-year-old female cleaner who doesn’t smoke working in an office earning an annual income of $50,000 can expect to pay on average $129 per month for a $3,125 monthly benefit. In comparison, an accountant who might work in the same office earning the same income would pay around $60 per month. Additionally, a receptionist in the same office would pay $64 for the same monthly benefit.

Interestingly, a waiter earning the same income could be paying on average $112 per month, while a chef in the same restaurant could pay on average $107 (an annual difference of $60 for the same level of cover). More examples of the amount a 32-year-old non-smoker could pay on average can be seen in the table below for a sample of occupations.

Article Source: Canstar

www.canstar.com.au